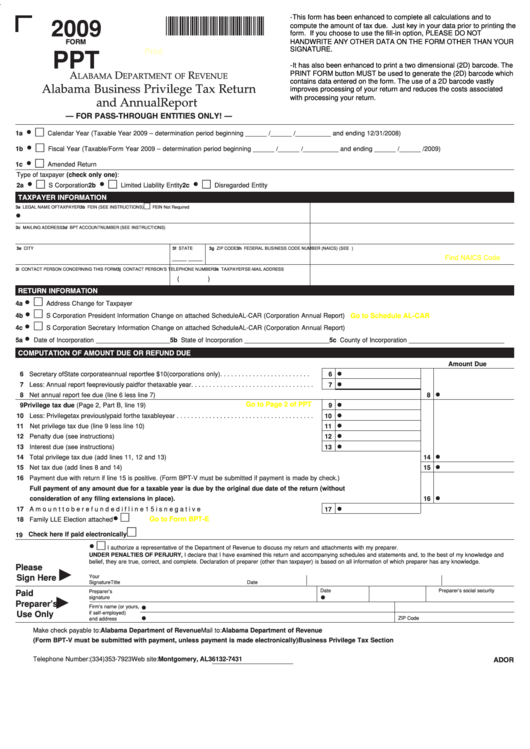

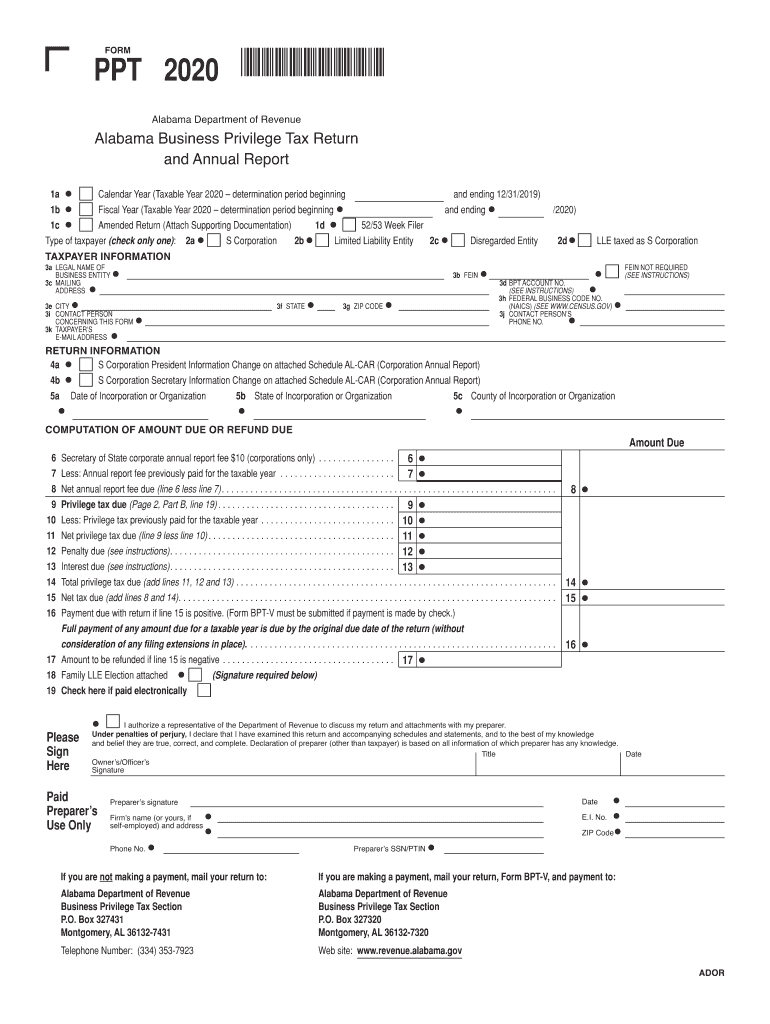

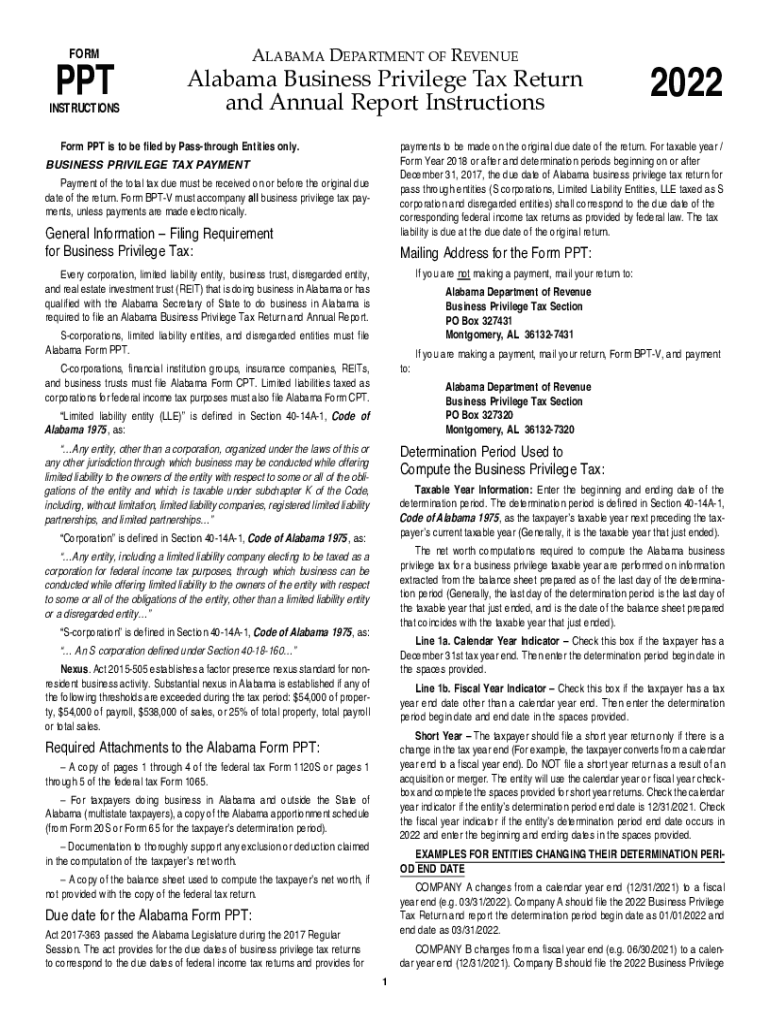

Al Ppt Form 2025. Annual reconciliation of alabama income tax withheld. In 2025, taxpayers whose business privilege tax is calculated as $100 or less are exempt from paying this tax and don’t have to file a business privilege tax return.

Taxpayers whose business privilege tax is calculated to be $100 or less are not required to file a business privilege tax return (bptin/cpt/ppt). On the left panel, select alabama business.

Fillable Alabama PPT 20202024 Form Fill Out and Sign Printable PDF, Here we have provided details about mp ppt 2025 with some instructions below: Alabama’s minimum business privilege tax would be cut in half in 2025 and eliminated completely starting in 2025, under hb391/sb290.

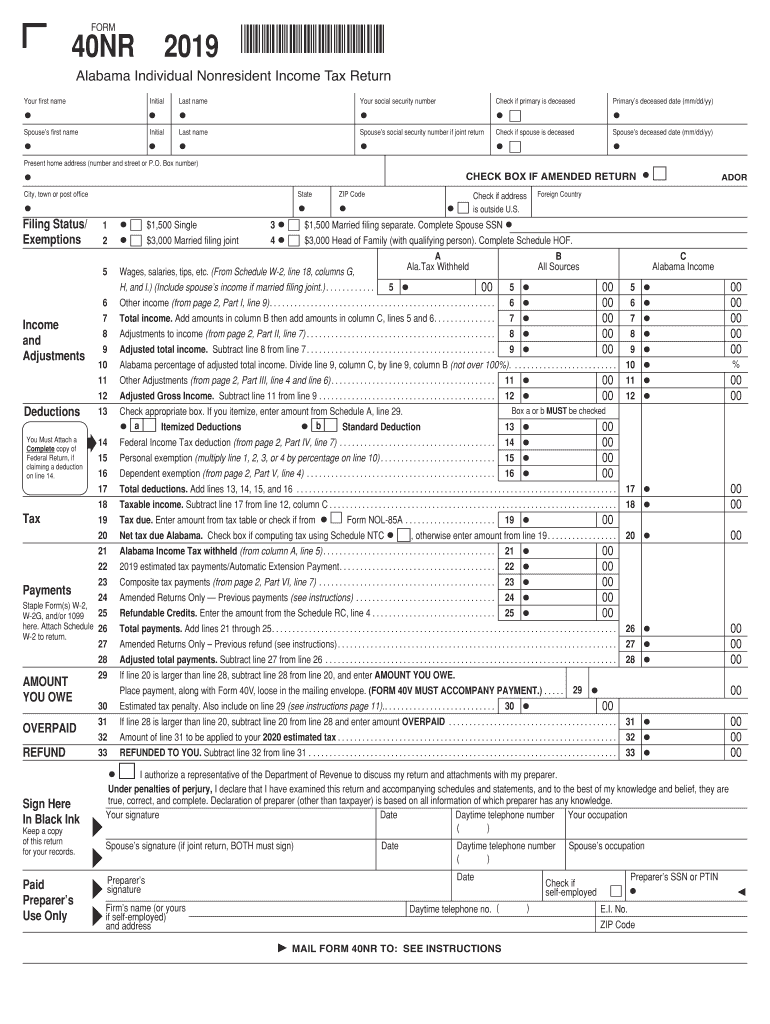

Instructions for Alabama 40nr 20192024 Form Fill Out and Sign, Alabama house bill 391 reduced the minimum state business privilege tax in 2025 from $100 to $50. Alabama business modernized electronic filing (mef) information:

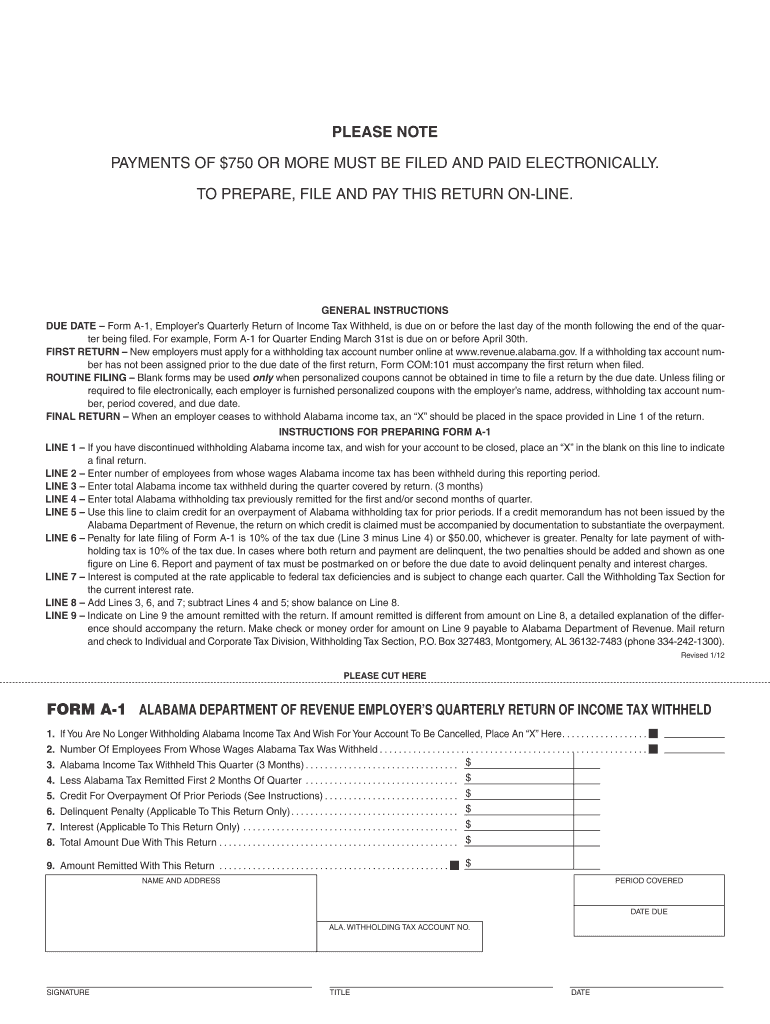

2012 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller, Privilege tax is filed and paid for the upcoming tax year, so the. For years prior to january 1, 2025, every corporation, limited liability entity, and disregarded entity doing business in alabama or organized, incorporated, qualified, or registered.

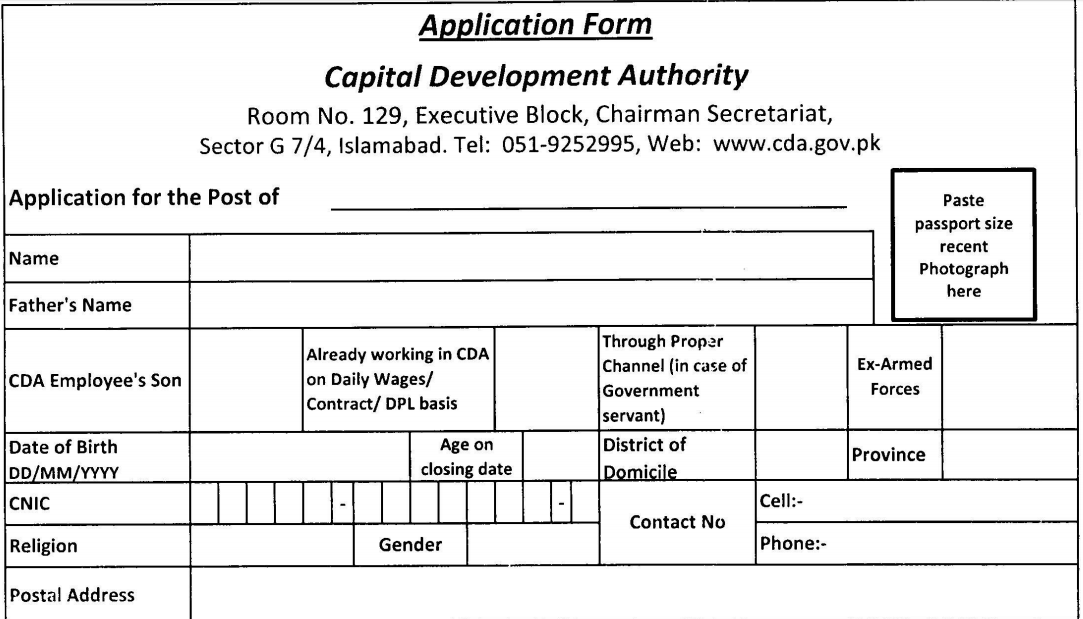

CDA Hospital jobs application form 2025, Alabama house bill 391 reduced the minimum state business privilege tax in 2025 from $100 to $50. Alabama’s minimum business privilege tax would be cut in half in 2025 and eliminated completely starting in 2025, under hb391/sb290.

2025 Reservation Form The Missouri Valley Arms Collectors Association, Touted as a huge tax cut for the support of small businesses, this new law has an estimated cost of $23 million by 2025. Beginning in 2025, businesses that are subject to the minimum.

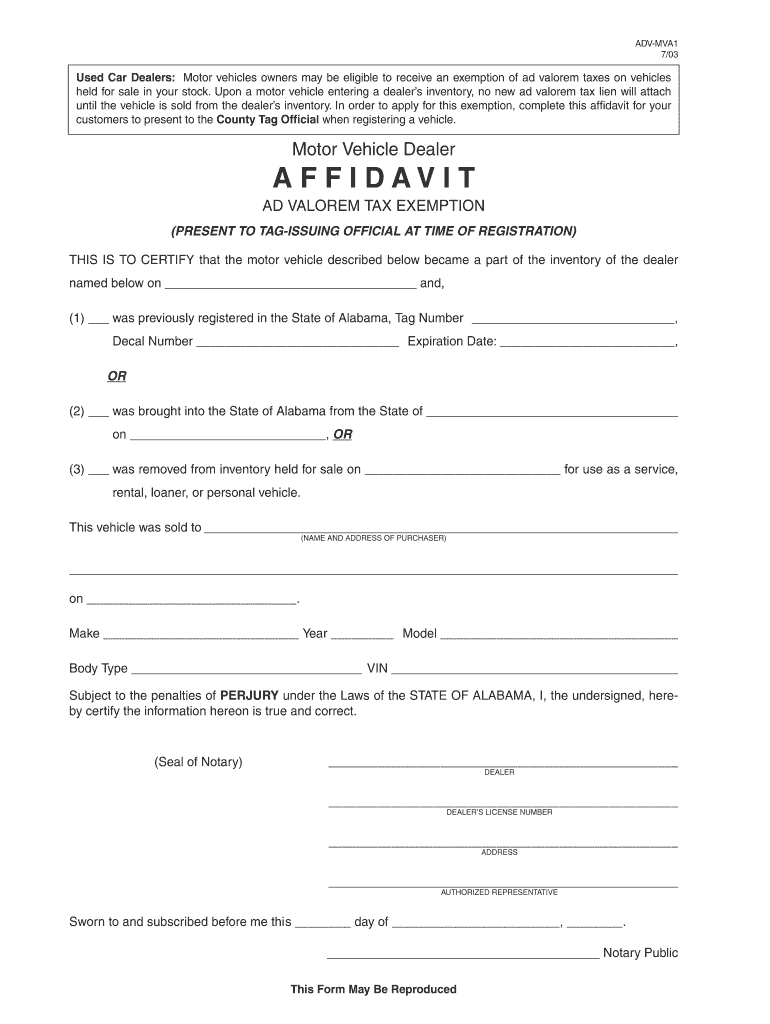

Alabama Affidavit of Correction 20032024 Form Fill Out and Sign, Subchapter k entities (partnerships) and s corporations. By intuit•13•updated june 28, 2025.

KLMEE Admission 2025, Application form, Eligibility, Syllabus, etc., Taxpayers whose business privilege tax is calculated to be $100 or less are not required to file a business privilege tax return (bptin/cpt/ppt). There is now a full exemption from the business.

EDV 2025 Opening Date In Nepal DV Lottery Form 2025 Without Passport, Taxpayers whose business privilege tax is calculated to be $100 or less are not required to file a business privilege tax return (bptin/cpt/ppt). Touted as a huge tax cut for the support of small businesses, this new law has an estimated cost of $23 million by 2025.

Al PPT Instructions 20222024 Form Fill Out and Sign Printable PDF, Beginning in 2025, businesses that are subject to the minimum. By intuit•13•updated june 28, 2025.

Fillable Form Ppt Alabama Business Privilege Tax Return And Annual, In 2025, taxpayers whose business privilege tax is calculated as $100 or less are exempt from paying this tax and don’t have to file a business privilege tax return. Common questions for ca form 3523 (research credit) in lacerte.